In the world of online transactions, two names stand out: Stripe and PayPal. Both platforms offer various services, from processing online payments to providing financial infrastructure for businesses. This article will delve into a detailed comparison of PayPal vs Stripe, examining their features, pricing, ease of use, and more.

Stripe vs PayPal: A comprehensive comparison of business payment platforms

Overview of Stripe and PayPal

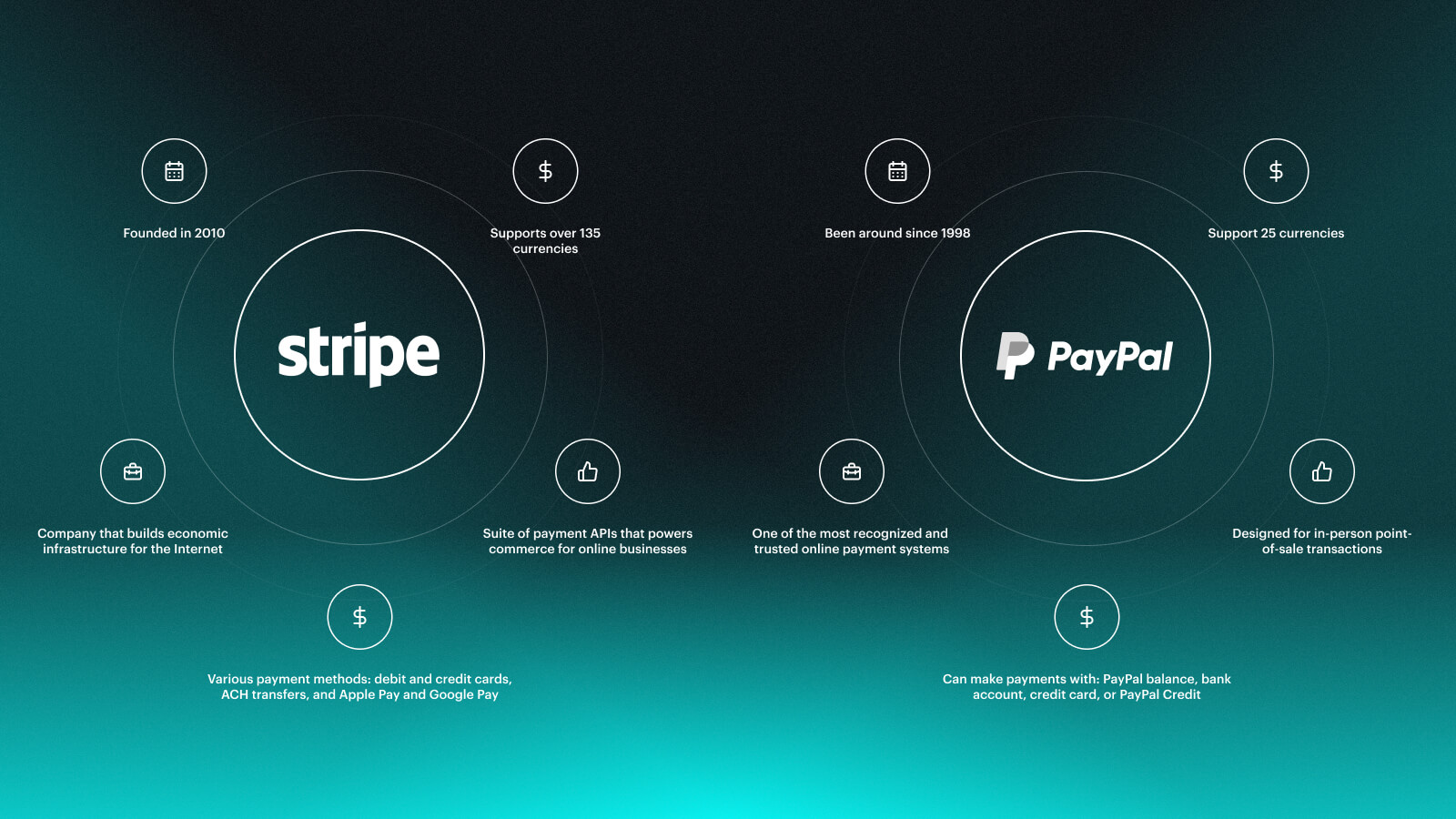

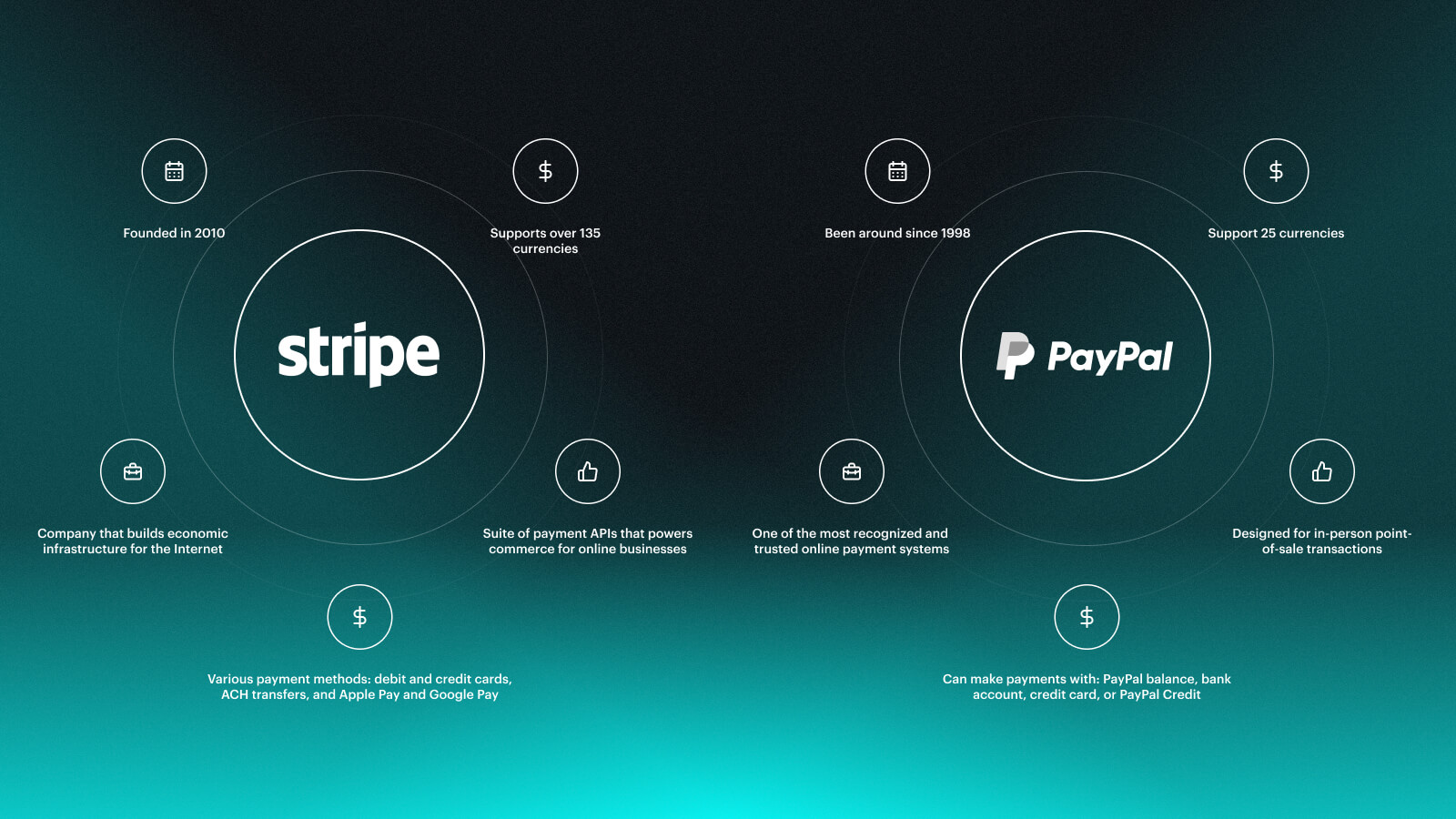

Stripe: Founded in 2010, Stripe is a technology company that builds economic infrastructure for the Internet. Businesses of every size, from startups to public companies, use Stripe’s software to accept payments and manage their businesses online. It offers a suite of payment APIs that powers commerce for online businesses of all sizes, including fraud prevention and subscription management.

Stripe’s payment processing capabilities are extensive. It supports over 135 currencies, making it ideal for businesses with international customers. Stripe accepts various payment methods, including debit and credit cards, ACH transfers, and popular mobile payment wallets like Apple Pay and Google Pay. For example, an e-commerce store built on Stripe can offer customers the flexibility to pay with their preferred payment method, whether it’s a credit card or a mobile wallet.

PayPal: PayPal has been around since 1998 and is one of the most recognized and trusted online payment systems. It allows customers to make payments and money transfers through the Internet. With over 360 million active users, PayPal is a popular choice for both businesses and consumers.

PayPal offers a wide range of payment options. Customers can make payments using their PayPal balance, bank account, credit card, or PayPal Credit. PayPal’s payment processing includes PayPal Checkout, which provides a seamless checkout experience for businesses operating online. Additionally, PayPal Here is designed for in-person point-of-sale transactions, making it suitable for businesses with physical retail locations.

Exploring the features: A detailed Stripe PayPal comparison

When it comes to selecting a payment platform for your business, understanding the difference between Stripe and PayPal is crucial. In this section, we will delve into a detailed comparison of the features offered by Stripe and PayPal. By examining their payment processing, security measures, developer tools, customer support, and more, we compare PayPal and Stripe so that you can make an informed decision about which platform best suits your business needs.

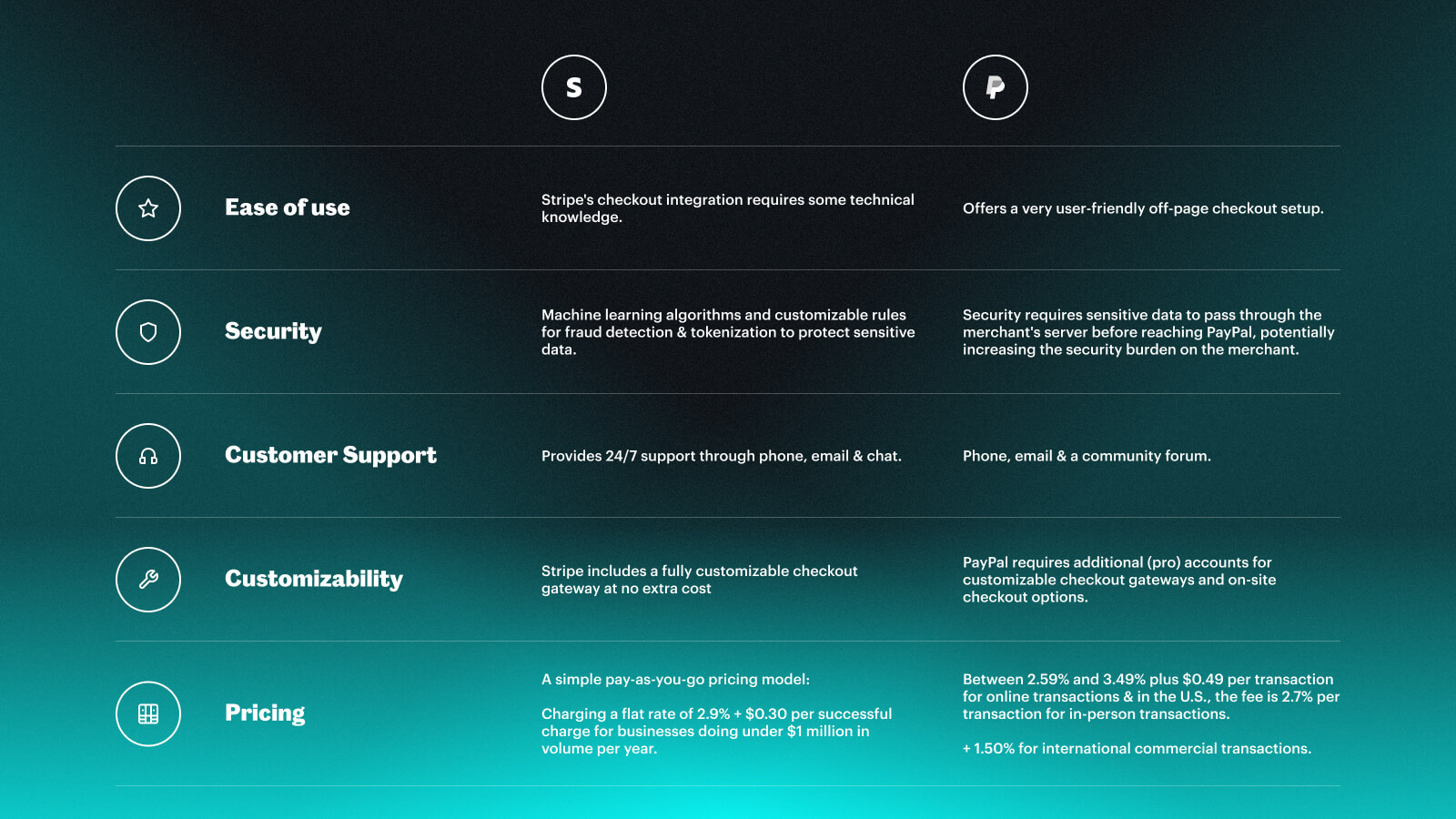

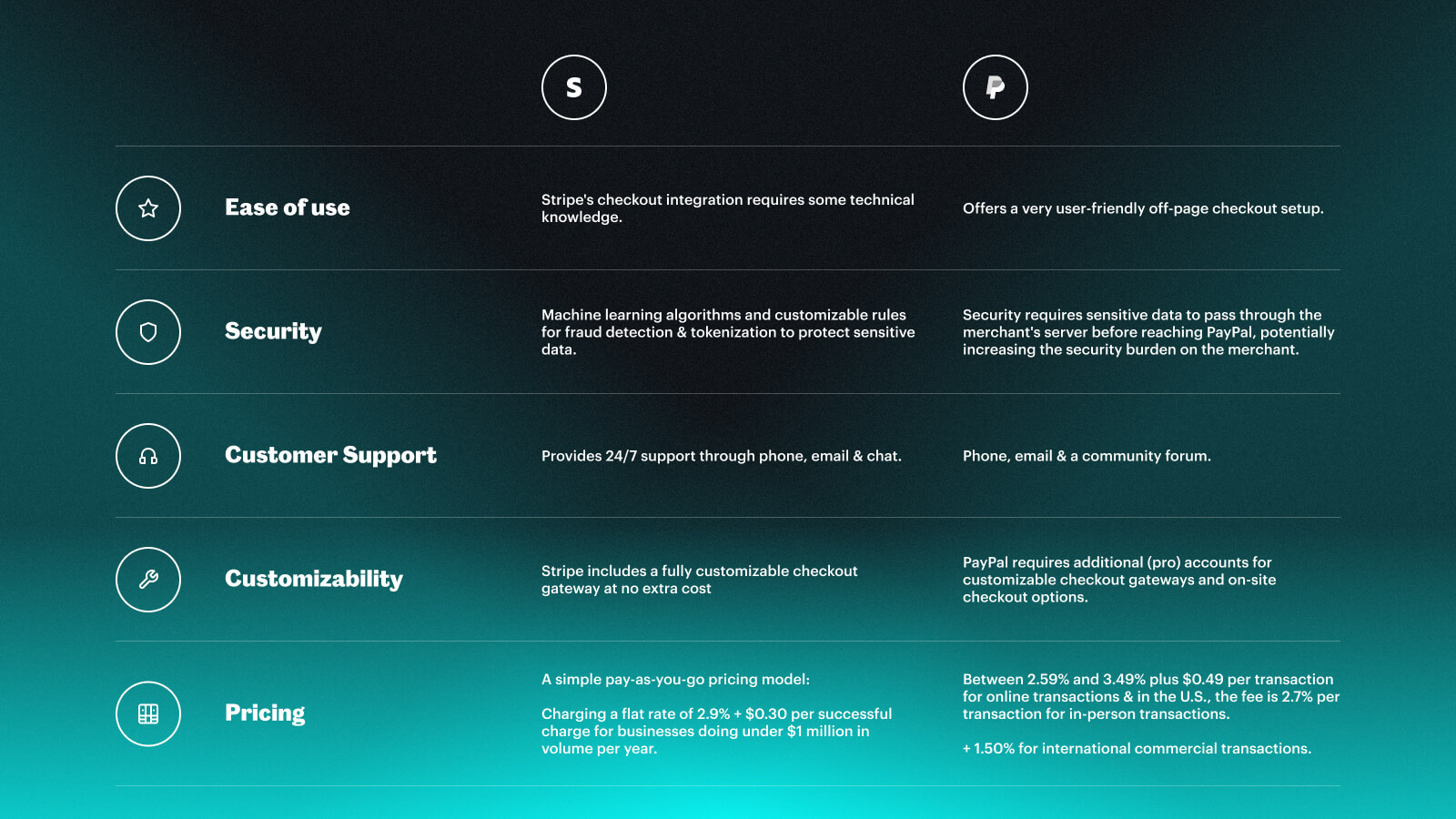

Comparison of payment processing solutions

Stripe

- Offers all-in-one payment processing solutions, combining payment processing with a payment gateway.

- Prioritizes eCommerce, offering a robust suite of developer tools for integrating payment features into online stores.

- Supports numerous currencies and payment methods, including credit cards and ACH transfers.

- Operates on a simple pay-as-you-go pricing model, charging a flat rate of 2.9% + $0.30 per successful charge for businesses doing under $1 million in volume per year.

PayPal

- It also provides all-in-one payment processing solutions, primarily focused on eCommerce.

It can be used for POS payments through PayPal Zettle or a third-party partner. - Allows merchants to add PayPal buy buttons to their site for no monthly cost, but for a monthly fee, they get a virtual terminal, a hosted checkout page, and recurring billing.

- Has a more complex fee structure. For online transactions, charges are between 2.59% and 3.49% plus $0.49 per transaction. For in-person transactions using PayPal Here in the U.S., the fee is 2.7% per transaction. There’s also an extra percentage-based fee of 1.50% for international commercial transactions, which includes currency conversions.

Both platforms

- Offer strong support for international commerce.

- Provide the ability to customize payment processes.

- The choice between the two often depends on your business’s specific needs and priorities.

Security

Security is a crucial aspect of online transactions. Let’s take a look at the difference between PayPal and Stripe in how they offer measures to protect businesses and their customers.

Stripe employs advanced security measures to safeguard transactions. It uses machine learning algorithms and customizable rules for fraud detection, enabling businesses to set specific parameters to identify and prevent fraudulent activities. Stripe’s Radar, a set of modern tools, further enhances fraud detection and prevention efforts.

In addition, Stripe utilizes tokenization to protect sensitive data. Tokenization replaces sensitive information, such as credit card details, with unique identification symbols. This method retains essential information without compromising security, reducing the risk of data breaches.

PayPal also prioritizes security and offers fraud protection, data encryption, and dispute resolution services. However, unlike Stripe, PayPal’s security measures require sensitive data to pass through the merchant’s server before reaching PayPal, potentially increasing the security burden on the merchant.

Please note that while both platforms are secure, no system can be completely secure, and it’s important for businesses to implement their own security measures as well.

Developer tools

Developer-friendly tools and resources are vital in integrating payment systems into businesses’ websites or applications. Stripe and PayPal offer developer tools to simplify the integration process, but there are differences in their offerings.

Stripe stands out for its developer-friendly infrastructure. It provides robust APIs and extensive documentation that allow developers to customize the platform to their needs. Stripe’s APIs are organized around REST, making it easier for developers to understand and work with. The use of predictable, resource-oriented URLs and HTTP response codes for API errors enhances the development experience.

Developers can use Stripe’s APIs to create custom checkout experiences tailored to their business requirements. This flexibility is precious for businesses that want to maintain a consistent brand experience throughout the customer journey.

PayPal has improved its developer tools, offering RESTful APIs and SDKs for various programming languages. While PayPal’s developer tools have evolved, Stripe’s commitment to developer-friendly tools and consistent updates gives it an edge in this category.

Customer support

Access to reliable customer support is essential when businesses encounter issues or have questions about payment processes. Let’s explore the Paypal and Stripe difference when it comes to customer support offerings.

Stripe

Provides 24/7 support through phone, email, and chat.

Offers comprehensive documentation and resources for developers, making it easier to find answers and troubleshoot technical challenges.

PayPal

Offers customer support through various channels, including phone, email, and a community forum.

Some users have reported slower response times compared to Stripe.

Provides resources and documentation, but Stripe’s robust support options give it an advantage in this aspect.

Ease of use

The ease of use of a payment platform can significantly impact businesses, especially those with limited technical expertise. Let’s examine the ease of use factors for Stripe versus PayPal.

Stripe’s checkout integration requires some technical knowledge. It involves integrating the Stripe checkout gateway with a website, which can be a bit challenging for non-technical users. However, Stripe’s flexibility allows businesses to create highly customized checkout experiences tailored to their brand.

PayPal, on the other hand, offers a very user-friendly off-page checkout setup. Integrating PayPal as a payment option typically involves adding a button or a link that redirects customers to PayPal’s secure checkout page. This simplicity makes PayPal a straightforward choice for businesses prioritizing ease of use.

Recurring payments

Recurring payments are crucial for businesses that offer subscription-based services. Let’s compare the recurring payment capabilities of Stripe and PayPal.

Stripe includes a recurring payment setup at no additional charge. Businesses can easily set up recurring payments and manage subscription plans within the Stripe platform. This feature is handy for subscription services, membership-based businesses, or businesses that need to bill customers on a recurring basis.

PayPal Business merchants can also set up recurring payments with no additional monthly fee. However, it’s important to note that PayPal’s per-transaction fee for recurring payments is typically higher than Stripe’s.

International payments

For businesses operating globally, it’s important to consider the capabilities and fees associated with international payments. Let’s explore how Stripe and PayPal handle international transactions and look at Stripe fees vs PayPal fees.

Stripe charges a simple, low-cost added fee for international transactions and currency conversions. This makes it convenient for businesses to accept payments from customers worldwide without incurring exorbitant fees. Additionally, Stripe’s support for over 135 currencies allows businesses to offer localized payment options and expand their global reach.

PayPal, on the other hand, charges a higher added fee for international transactions and currency conversions. This can be a significant consideration for businesses that engage in a substantial volume of international transactions. It’s important to carefully evaluate the PayPal vs Stripe fees associated with cross-border payments and currency conversions to ensure they align with your business’s international payment needs.

Customizability

Customizability is an important aspect for businesses that want to tailor their payment experience to match their branding and user experience. Let’s examine the customizability options for Stripe v PayPal.

Stripe includes a fully customizable checkout gateway at no extra cost. Businesses can design and create a checkout experience that aligns with their brand identity. This level of customizability allows businesses to maintain a consistent look and feel throughout the payment process.

On the other hand, PayPal requires additional accounts for customizable checkout gateways and on-site checkout options. Payments Pro ($30/month) or Payflow Pro ($25/month) accounts are necessary to unlock advanced customization features. These additional fees can be a consideration for businesses seeking extensive customizability without incurring extra costs.

Currencies&transfer types supported

The range of supported currencies and transfer types is important, particularly for businesses with diverse customer bases.

For Stripe:

- It supports over 135 international currencies.

- It supports a variety of payment methods, including credit cards, ACH (Automated Clearing House) transfers, and various mobile wallet payments like Apple Pay.

- It also supports local payment methods used overseas.

For PayPal:

- It supports 25 currencies.

- It supports online and in-person payment processing, including credit and debit cards.

- It also allows for PayPal digital transactions.

- However, it does not support ACH transfers.

Please note that the support for specific currencies and transfer types might vary based on the country and the specific services or plans offered by Stripe and PayPal. It’s always good to check their official websites for the most accurate and up-to-date information.

Trustworthiness and brand familiarity

A payment processor’s trustworthiness and brand familiarity can impact consumer confidence and adoption. Let’s examine the trustworthiness and brand familiarity of Paypal v Stripe.

PayPal has established itself as a highly trusted payment processor with a high level of trust and security across demographics. Its longevity in the industry and widespread use contribute to its brand familiarity. Due to its well-known name and reputation, many customers feel comfortable paying through PayPal.

While Stripe has a different level of brand recognition than PayPal, it has gained trust through its commitment to security and its growing market presence. Stripe’s security measures, comparable to PayPal’s, give businesses and consumers confidence in their transactions. As Stripe expands and establishes its presence, its trustworthiness and brand familiarity will likely increase.

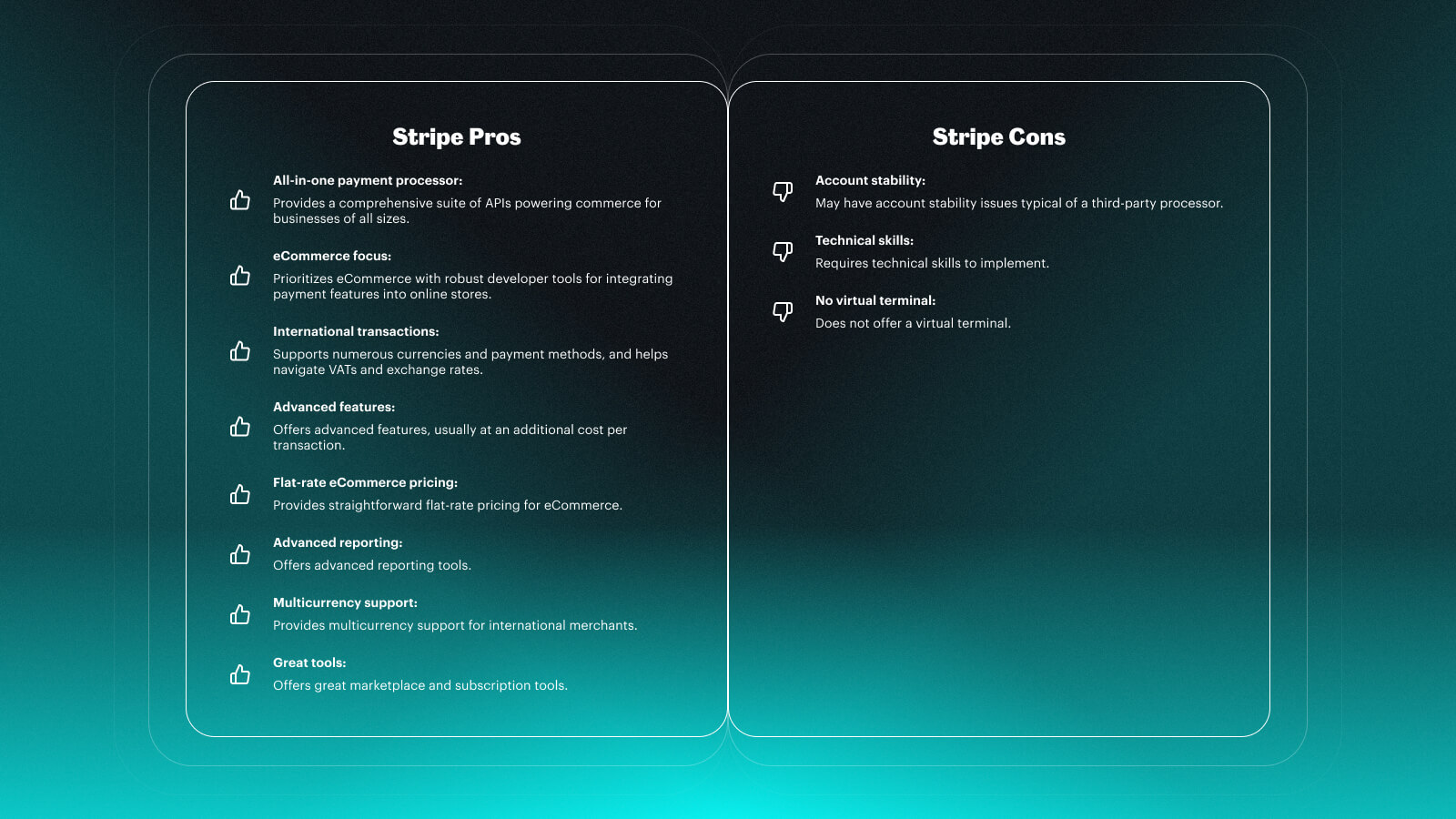

Pros and cons of Stripe

Stripe Payments offers a comprehensive solution for businesses, particularly those focused on eCommerce, with a range of features designed to facilitate smooth and efficient transactions. Here are the key PayPal Stripe benefits and drawbacks to consider.

Pros of Stripe

- All-in-one payment processor: Combines payment processing with a payment gateway.

eCommerce focus: Prioritizes eCommerce with robust developer tools for integrating payment features into online stores. - International transactions: Supports numerous currencies and payment methods, and helps navigate VATs and exchange rates.

- Advanced features: Offers advanced features, usually at an additional cost per transaction.

- Flat-rate eCommerce pricing: Provides straightforward flat-rate pricing for eCommerce.

- Customizability: Highly customizable and developer-focused.

- Advanced reporting: Offers advanced reporting tools.

- Multicurrency support: Provides multicurrency support for international merchants.

- Great tools: Offers great marketplace and subscription tools.

Cons of Stripe

- Account stability: You may have account stability issues typical of a third-party processor.

- Technical skills: Requires technical skills to implement.

- No virtual terminal: It does not offer a virtual terminal.

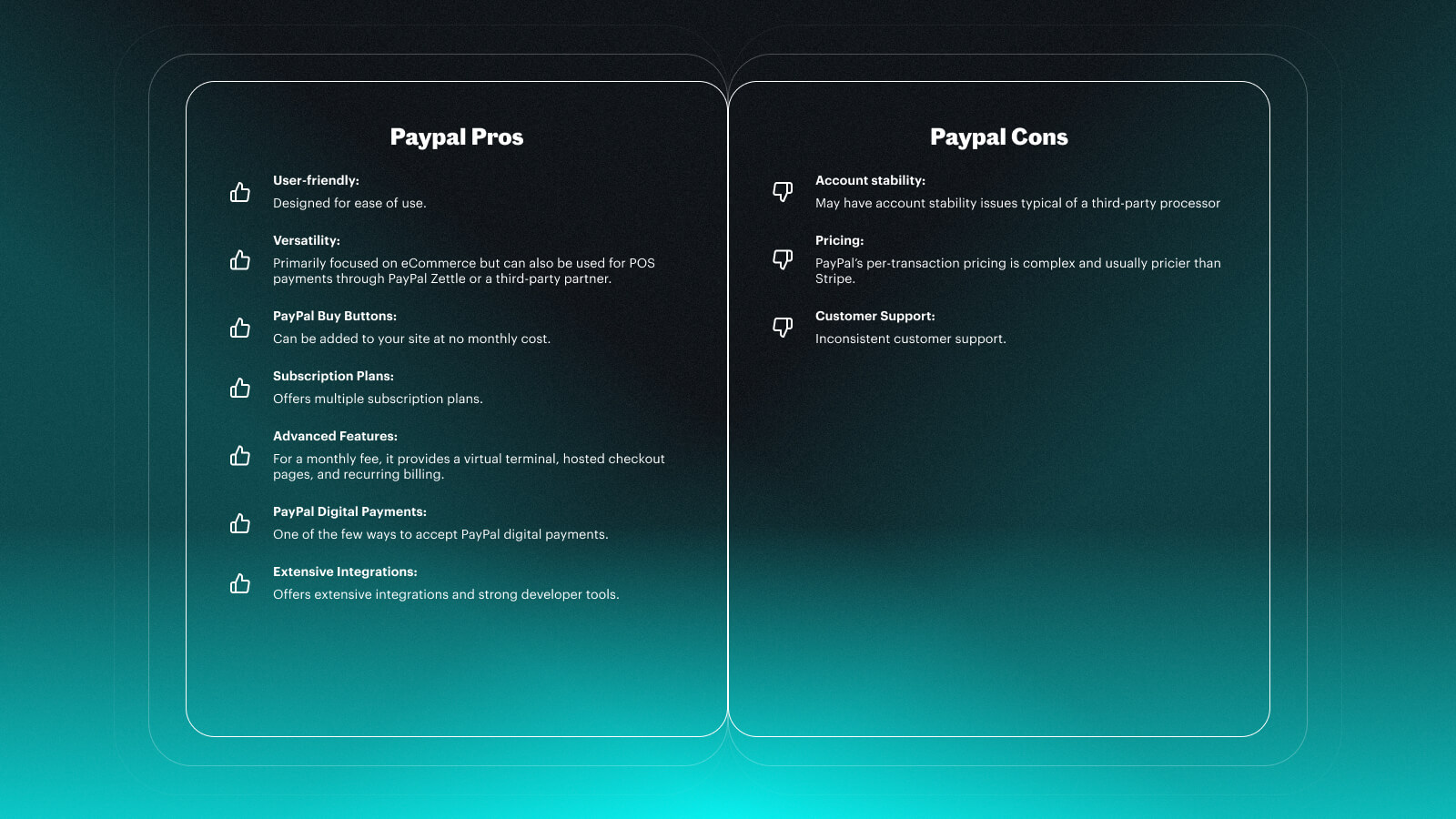

Pros and cons of PayPal

PayPal offers various services, from digital wallets to loans, focusing on user-friendly payment processing. Here are the key benefits and drawbacks to consider:

Pros of PayPal

- User-friendly: Designed for ease of use.

- Versatility: Primarily focused on eCommerce but can also be used for POS payments through PayPal Zettle or a third-party partner.

- PayPal Buy Buttons: Can be added to your site at no monthly cost.

- Subscription Plans: Offers multiple subscription plans.

- Advanced Features: For a monthly fee, it provides a virtual terminal, hosted checkout pages, and recurring billing.

- PayPal Digital Payments: One of the few ways to accept PayPal digital payments.

Extensive Integrations: Offers extensive integrations and strong developer tools.

Cons of PayPal

- Account Stability: May have account stability issues typical of a third-party processor.

- Pricing: PayPal’s per-transaction pricing is complex and usually pricier than Stripe.

- Customer Support: Inconsistent customer support.

Choosing the right payment platform

If we compare Stripe and PayPal, we notice that both are powerful platforms that can handle various payment processing needs. The choice between the two ultimately depends on the specific requirements and circumstances of your business.

If you need a platform that offers a comprehensive suite of tools, extensive customization options, and a developer-friendly infrastructure, Stripe is an excellent choice. Its robust APIs, support for various payment methods and currencies, and commitment to security make it ideal for businesses looking for flexibility and customization.

On the other hand, if you prefer a simple, straightforward platform that’s easy to use or if you already rely on PayPal for other aspects of your business, PayPal might be the better option. With its widespread recognition, user-friendly interface, and trusted brand, PayPal suits businesses seeking an accessible payment solution.

It’s important to assess your business’s specific needs, such as international payment capabilities, customizability requirements, recurring payment setup, and cost considerations when making a decision between Stripe and PayPal.

As these platforms continue to evolve and improve, they will offer better services, features, and pricing options for businesses of all sizes. It’s advisable to stay informed about any updates or changes to their services and evaluate how they align with your business’s evolving needs.